SENIORS

What is the Donut Hole?

More and more employers are beginning to integrate wellness programs into their benefits. Learn more.

What is the Donut Hole?

Medicare has strict regulations around its prescription drug plans, and one of the most commonly asked about features is ‘the donut hole’. Also known as, ‘the coverage gap’, this benefit structure applies to both stand-alone Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug plans, but not everyone enters it. If you’re currently taking medications or are concerned about lowering your prescription drug costs, it may be helpful for you to understand what the Medicare ‘Donut Hole’ is and how to avoid it.

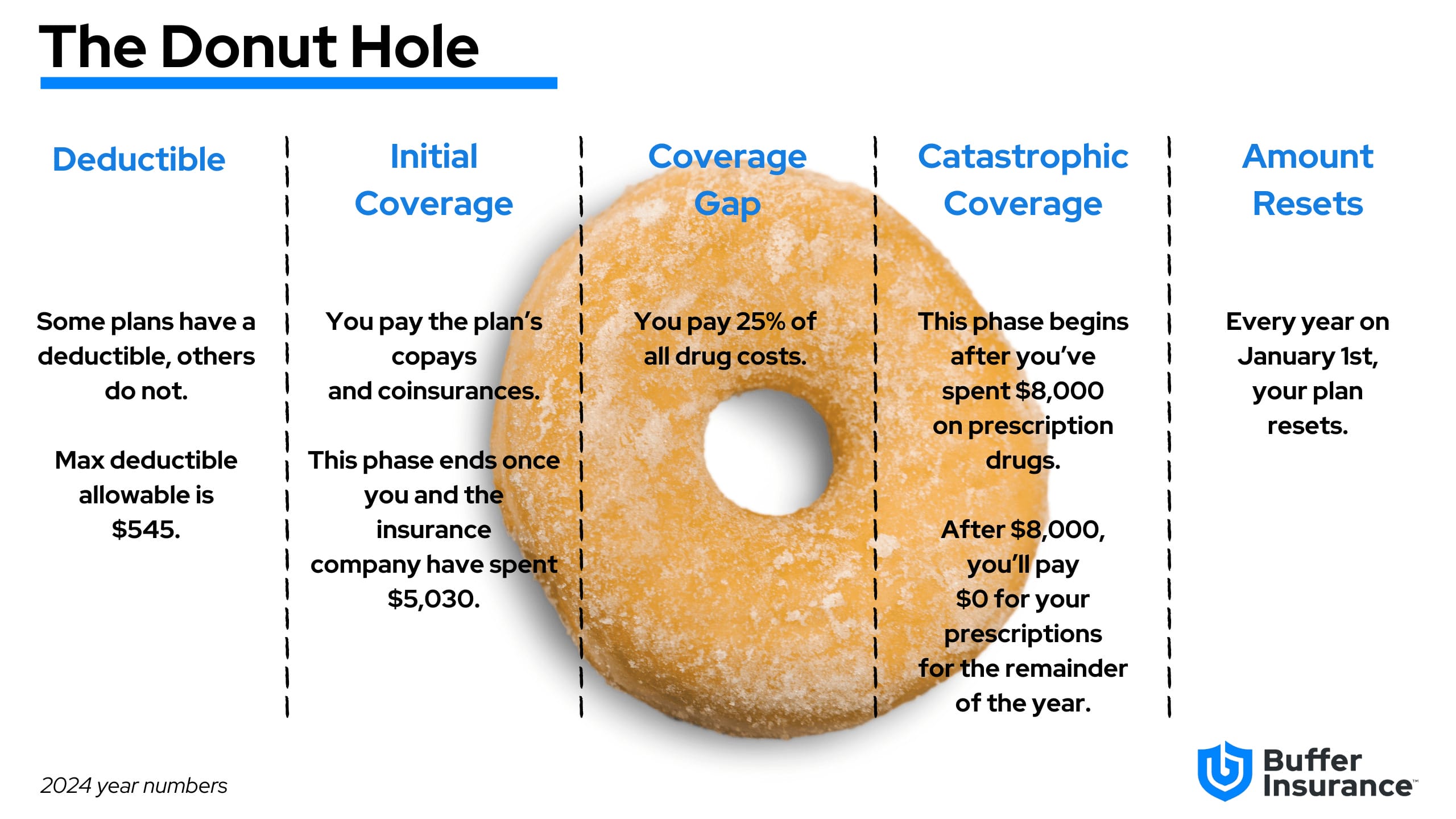

2024 Prescription Benefit Chart

It may help you to understand the overall progress an individual may encounter as they fill their prescriptions throughout the year. This chart will serve as a useful aid. It describes the various stages that you may encounter. While a prescription plan is not required to have a deductible, if the plan does not, it is required to have an actuarial amount that is the same.

Coverage Gap

The coverage gap, commonly referred to ask “The Donut Hole” is a temporary limit on what most Part D Prescription Drug Plans or Medicare Advantage Prescription Drug plans pay for prescription drug costs. While you’re in the coverage gap, you might pay higher costs for brand-name and generic drugs. Below we’ve described each phase of Part D (coverage gap included):

- Deductible Phase: For most stand-alone Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug plans, you’ll pay 100% for medication costs until you reach the yearly deductible amount (if your plan has one). The standard deductible for 2024 is $545 and no plan’s deductible can be higher than that amount.

- Initial Coverage Phase: After you’ve reached the deductible, if you have one, you’ll enter the initial coverage phase, where you will pay the plan’s cost share for covered medications. For example, if your plan has a $0 copay for Tier 1 drugs in this phase and you’re taking a medication that is Tier 1, your out-of-pocket-cost for that drug would be $0 a month.

- Coverage Gap Phase (aka “donut hole”): begins if you and your plan spend a combined $5,030 in 2024 as described above. While in the coverage gap, you’ll typically pay 25% of the plan’s cost for your drugs. For example, if you’re taking an expensive, brand-name medication that costs $600, you would be responsible to pay $125 (25%) for a month’s supply of that drug.

- Catastrophic Coverage Period: Fortunately, many people do not reach this phase of Part D. This phase begins if your drug costs in 2024 reach $8,000; on average, you will have spent $3,300 out of your own pocket when you enter this phase. In previous years, you’d be responsible to pay a small coinsurance or copayment for covered prescription drugs for the remainder of the year. After the catastrophic coverage phase is reached in 2024, you will pay $0 toward the cost of your drugs for the remainder of the year.

Closing the Gap

Recent legislation has been signed to which will eliminate the coverage gap by 2025. In 2025, once YOU have spent $2,000 towards the cost of drugs, you will skip the Coverage gap and enter Catastrophic coverage.

| Year | Percent You pay for Brand Name Drugs | Percent You pay for Generic Drugs |

|---|---|---|

| 2023 | 25% | 25% |

| 2024 | 25% | 25% |

| 2025 | 0% | 0% |

Tip

It can be a good idea to review your Medicare Prescription Drug Plan coverage every year, to see if your plan covers the medications you need now and may need in the upcoming year.

Request your Personalized Drug Costs Report

Saving money on your prescriptions is important. We’re here for you.