SENIORS

Long-term Care Insurance

Learn about how to prepare for the expensive costs of nursing and assisted living homes.

What is Long-term Care Insurance?

If you develop a chronic illness or become disabled and can no longer care for yourself for an extended period of time, you’ll need long-term care services.

Families are often hit the hardest when a loved one requires Long Term Care (LTC). Caregivers can be dramatically impacted by having to take absences from work to accompany on doctor visits, possibly bathing, and even cooking meals. This disruption may cause resentment from both the caregiver and the person needing care.

Long Term Care insurance is purchased to protect both your relationships and your assets, should you require assistance later in life.

What are Activities of Daily Living?

Of course, there are requirements for a person to meet in order to trigger this Long Term Care benefit from their policy. These triggers are referred to as Activities of Daily Living, ADLs for short. Most policies require that you need assistance with two or more ADLs from the following categories, before they will recognize the need for assistance. These below are known as basic ADLs:

- eating

- bathing (ability to clean oneself, shaving, brushing teeth, etc)

- getting dressed (without struggling with buttons and zippers)

- toileting

- transferring (moving from bed to wheelchair)

- continence (ability to control one’s bladder)

There is a second group of ADLs that include more complex tasks, and are known as instrumental ADLs:

- Using a telephone

- Managing medications

- Preparing meals

- Housekeeping

- Managing personal finances

- Shopping for groceries or clothes

- Accessing transportation

- Caring for pets

Who needs to Buy Long Term Care Insurance?

The first thing we recommend that people do if they are considering LTC insurance is to ask themselves a series of questions. Depending on the answers to these questions, will help you determine if you need to apply for a policy:

- Do you have children who live close to you?

- Will those children be willing and able to assist you with any of the ADLs listed above?

- Do you have assets or investments that you want to protect from being spent on care?

- What is your family’s health history?

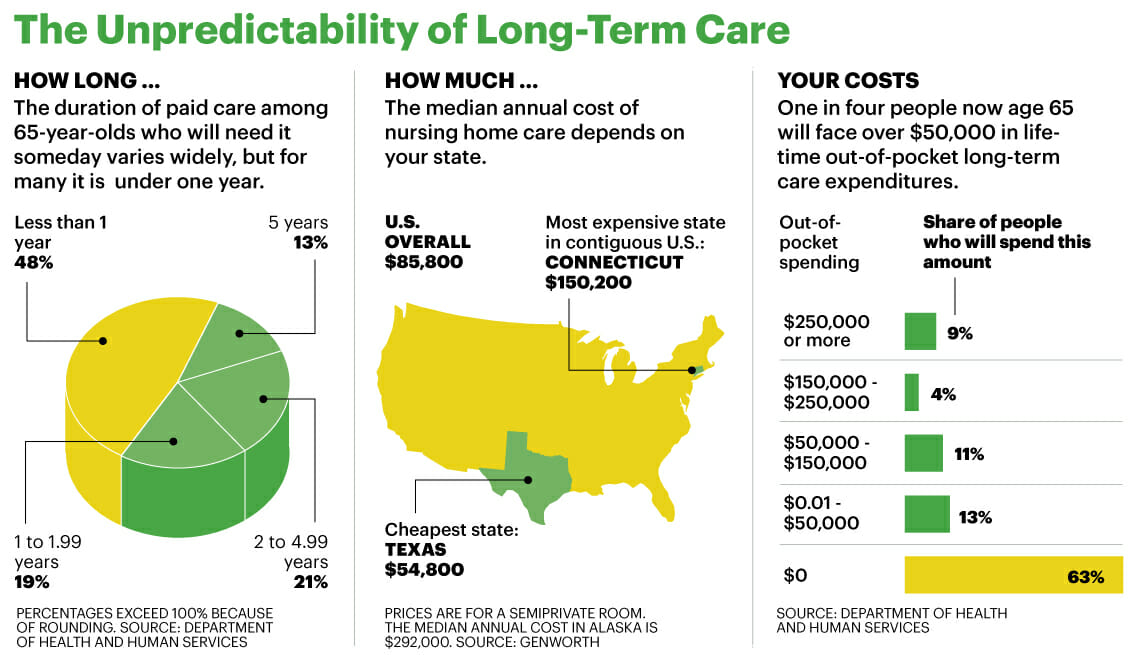

These are several important questions to jumpstart the conversation about LTC. Statistics show that 52% of people turning age 65 will need some long-term care services in their lifetime.

When do I Need to Buy Long Term Care Insurance?

The best answer for most people is in their mid-50’s. Why? Because adults are still healthy and can also afford it at that point.

You can receive discounts when applying for coverage, for example: couples sharing a policy will receive dramatically reduced rates. You can also receive favorable rates if you are in good health.

Here are some numbers based on a study performed by the American Association for Long-Term Care Insurance:

13.9%: Percentage of applicants ages 50-59 denied long-term care coverage due to health issues.

23%: Percentage of applicants ages 60-69 denied long-term care coverage due to health issues.

44.8%: Percentage of applicants ages 70-79 denied long-term care insurance due to health issues.

Possible denial due to health is one reason to apply early. Another reason to purchase when you’re young is because the prices will be much more favorable. Waiting 5 or 10 years can significantly balloon the cost of insurance.

What Types of Policies are Available for LTC?

If you are electing to pay for a LTC policy through your employer, it is important to ask whether that policy is portable or not. Meaning, if you leave or are terminated from your employer, can you keep the policy inforce.

A helpful resource to review is ‘A Shopper’s Guide to Long-Term Care Insurance‘, produced by the Texas Department of Insurance.

Traditional Long Term Care Policy

Traditional long-term care insurance can be purchased as an individual or through your employer. These types of policies are much like your auto insurance. For the reason that, if you stop paying premiums you lose coverage. However, unlike auto insurance, where insurance companies penalize bad drivers or even drop coverage for individuals who have had accidents. LTC insurance companies only raise rates for specific demographics of people, rather than on an individual basis. You also can not lose coverage for having a claim.

Purchasing LTC from your employer can be advantageous because an insurance company selling 50 policies will discount the price, making premiums more affordable. Also, employers may also contribute toward these. The downside is that you may not be free to determine the benefits, elimination periods, or terms of the policy.

Life Insurance With a Long Term Care Rider

A newer form of long-term care insurance is a combination between a whole life policy and a long term care coverage. These hybrid policies serve two needs.

The first need being, that it serves as life insurance, which offers a specific amount as a death benefit. The second role being that, should you require long-term care services, the death benefit can be used toward those services as well.

Asset-based plans are generally funded in a single payment, 10 equal payments, or continuous/on-going payments. They provide the following benefits:

- Guaranteed PremiumsRates will never increase

- Death BenefitPayable tax-free to your beneficiary

- Surrender ProvisionCancel your policy for a return of premium

In recent years the cost of traditional LTC insurance has skyrocketed, causing policyholders to either force to lessen their benefits or drop their policy altogether. Because of the level-premiums offered on these hybrid policies, you don’t have to worry about premium increases putting your care in jeopardy.

Tip

It is common for siblings to go-in together to purchase a long-term care policy for their parents. Parents do not want to be a burden on their kids.

Estimated Costs of Care by Type

The cost of care can depend greatly on where the care is given. The median cost for a home-health aide for an eight-hour day is close to $62,000 a year, while nursing care in a facility with a private room has a median cost of almost $108,000 a year.1

| Type of Care | 2021 |

|---|---|

| Private Room in Nursing Home | $9,034 |

| Semi-Private Room in Nursing Home | $7,908 |

| Home Health Aide | $5,148 |

| Home Care: Homemaker | $4,957 |

| Assisted Living Facility | $4,500 |

| Adult Day Care | $1,690 |

Source: AARP, Nicholas Rapp, AARP Bulletin, 5 Things You Should Know About Long-Term Care Insurance, Article Link. All Rights Reserved.

Tip

It is common for siblings to go-in together to purchase long-term care for their parents. Parents many times do not want to be a burden on their kids.

Home Care

Generally, home care is appropriate whenever a person prefers to stay at home but needs ongoing care that cannot easily or effectively be provided solely by family and friends. More and more seniors, electing to live independent, non-institutionalized lives, are receiving home care services as their physical capabilities diminish. It’s also a popular choice for younger adults and children coping with chronic conditions or disabilities.

More info on the National Association for Home Care and Hospice

Assisted Living Facilities

More info on The National Center for Assisted Living

Nursing Facilities

Nursing homes generally provide around-the-clock care and may offer medical, rehabilitative, personal and residential services. But all this care comes at a price: the median price for a private room in a nursing home is almost $84,000 a year, and that cost can be significantly more in certain regions.2 Prices and services often vary by location and facility, so it pays to shop around for the facility that meets your needs and budget.

More info on The American Health Care Association

Adult Day Care

Most programs operate during the week, and can be attended full or part time. Some programs offer services in the evenings and on weekends.

More info on The National Adult Day Services Association

Are your children going to take care of you?

Children are less likely to stand up and take the responsibility for aging parents. Get your coverage now.