Medicare coverage is not a one-and-done decision. Changing health care needs and life events may mean your Medicare coverage needs to change, too.

Medicare provides certain time periods for making changes to your plan choices. The main one is Medicare Open Enrollment. In addition, there are Medicare Special Enrollment Periods for changing plans at other select times when you qualify.

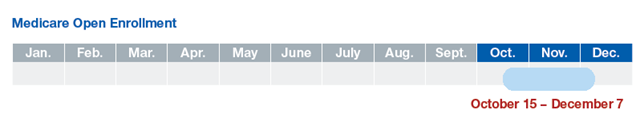

Medicare Open Enrollment

Medicare Open Enrollment happens every year, October 15 – December 7. It’s similar to the open enrollment you may have experienced with employer coverage, which generally happened in the fall. A big difference with Medicare is that you are likely to have more coverage choices than you did as an employee.

You can change your coverage choices during Medicare Open Enrollment if you choose to. Changes you make go into effect on January 1 of the following year. If you decide to keep your current plan, it will renew automatically for the next calendar year.

It’s a good idea to review your coverage annually. Medicare and private Medicare plans may change coverage and costs from year to year. You should receive an Annual Notice of Change, or ANOC, each fall that explains any plan changes taking effect the following year.

Changes You Can Make During Medicare Open Enrollment

Here are the kinds of changes you can make during Medicare Open Enrollment:- Change from Original Medicare (Parts A and B) to a Medicare Advantage (Part C) plan or vice versa.

- Switch from one Medicare Advantage plan to a different Medicare Advantage plan.

- Join, switch or drop a Medicare prescription drug (Part D) plan. You may be charged a premium penalty if you drop Part D coverage and want it again later.

- You may want to add a stand-alone prescription drug plan. Drug coverage is not provided with Original Medicare.

- You might consider adding a Medicare supplement insurance plan to help with some costs that Original Medicare doesn’t pay, like deductibles, co-pays, and co-insurance. Note that you may not have a guaranteed right to buy a Medicare supplement insurance plan at this time. You could be charged more or denied coverage. Be sure to check the laws in your state.

Choose a Medicare plan based on your needs.

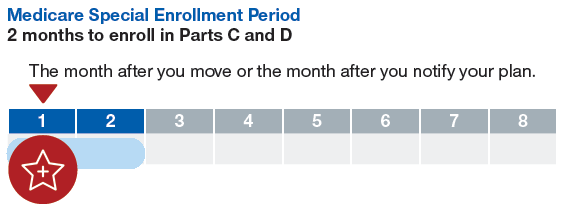

Medicare Special Enrollment Period

A Special Enrollment Period (SEP) allows you to join, change or drop a Medicare Advantage (Part C) or prescription drug (Part D) plan outside of Medicare Open Enrollment in certain situations, such as when you move. These situations are called “qualifying events.”

In general, you have 2 full months after the month of a qualifying event to make plan changes.

If you are moving, the timing of your SEP is based on when you notify your plan. If you notify your plan before you move, your SEP is based on the month that you actually move. If you notify your plan after you move, your SEP is based on the month that you notify your plan. In either case, your SEP lasts for 2 more full months.

Some common events that may qualify for this SEP include:- You’re moving outside your current Medicare plan’s service area. You’re moving within your current plan’s service area, but you have new plan options.

- You’re moving into or out of an institution.

- You’re leaving retiree, union or COBRACOBRA stand for the Consolidated Omnibus Budget Reconciliation Act. It’s a law that protects you and your family if you lose your employer-sponsored health benefits. If you qualify for COBRA coverage, then you have the option of continuing your employer-sponsored health plan for a limited period of time. coverage.

- You’re losing creditable drug coveragePrescription drug coverage from a health plan other than a Medicare Part D standalone plan or a Medicare Advantage plan that includes prescription drug coverage and that meets certain Medicare standards..

- Your current Medicare plan stops servicing your area.

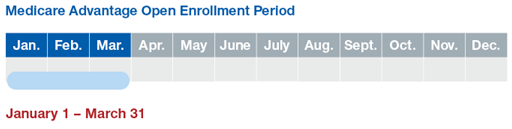

Medicare Open Enrollment Period

The Medicare Open Enrollment Period gives you a chance to change plans if you are already on a Medicare Advantage plan. This time period is new for 2019, and is expected to occur each year after. During this time frame: January 1 – March 31, an individual can change from one Medicare Advantage plan to another, or revert back to original Medicare with a standalone Prescription Drug Plan.

If you go back to Original Medicare at this time, you may enroll in a stand-alone Medicare prescription drug (Part D) plan. Drug coverage is not provided with Original Medicare. You may incur a premium penalty if you don’t enroll in a Part D plan at this time and decide you want to later.

You may also want to consider adding a Medicare supplement insurance plan to help with some costs that Original Medicare doesn’t pay, like deductibles, co-pays, and co-insurance. Note that you may not have a guaranteed right to buy a plan at this time. You could be charged more or denied coverage. Be sure to check the laws in your state.

Once you use your election to change plans during the Medicare OEP, you will not be able to make plan changes until the Annual Election Period. Any changes made will take effect the first of the following month.

0 Comments